A few weeks ago I gave a talk on my approach to investing, and as I formulated my thoughts into a coherent description, it struck me that it would make an interesting blog post, as well as be useful information for companies looking for funding. One caveat is that I’m pretty sure that this is a rather individual approach, and is not shared by the majority of angel investors out there.

Why do I invest?

Before I get onto my approach to investing, let me start by explaining why I invest and a bit of background on why people invest in general.

This entire thought process can be explained with economics and mathematics – we have an intrinsic utility function and we want to maximise lifetime utility achieved through spending money on things we consume.

If we plan for future consumption, and discount it, we can use a dynamic programming equation to work back and work out how much to spend at any point and how much to invest. There are many entirely inappropriate assumptions in this model, and I normally hate random equations but this one is highly relevant – everyone does this, otherwise we wouldn’t all pay into pensions or buy houses with a 25 year mortgage. This formula is the foundation on which we build all of our other reasons, and so it cannot be ignored. We need an income with which we can support ourselves and our family. We want to build wealth, in order to improve our quality of life and the options available to us.

But on top of all of this there are also non-financial reasons – we want to feel like we are making a difference, and that we are respected by and useful to our society. The first set of basic consumption based reasons does not motivate me – I am sure of my ability to support a family when I need to, and my own opinion is that expensive things just make you a target for bad luck. What I want is to change the world, and currently I think the best way to do that is through privatised space exploration.

Whatever your own personal dream ambition is, chances are that you will need money to be able to fulfil it – and the more ambitious it is, the more money you will need.

So let’s assume that although the main drivers and motivations are non-financial, we can still quantify our goal as financial – in my case, one billion pounds. There is also the timeframe to consider, as there is no point in making it all at a time when you cannot use it. So the goal needs to be reached quickly enough to be able to use the funds entrepreneurially for a long-term plan – in my case, this means in no longer than 30 years. The billion-pound question, quite literally, is how to make it?

As you read the biographies of successful investors like Warren Buffet, you quickly realise how much time, effort and dedication they put into learning to analyse companies, calculating valuations for them, and determining whether the operational teams had a good chance of success.

There are a couple of factors which can be singled out based on this – average daily effort, personal enjoyment of this kind of analysis, timeframe to success, and the chances of success.

To follow the approach of a successful investor, the values to the above should be: large, needs to be high, long, and low to average.

This applies for all kinds of investing, unless you take a hugely high-risk approach. You can make gambles, take chances, and if you’re lucky and are in a bull market, you can make a fortune. If you can manage other people’s money along the way, then you can leverage this up even further. For this the values are medium, high, medium and almost zero. This is high risk – for every success there are a thousand failures.

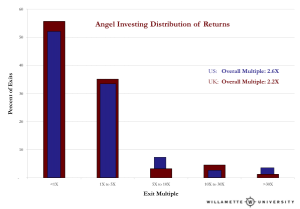

So if you don’t follow the risky, gamble-based approach, success as an investor requires many years of hard work, with a bit of luck along the way. According to the largest report on angel investing returnsever produced, angel investors in the UK make on average a 2.2x return over 4 years. Assuming you start with 2 million, don’t spend anything, and achieve these returns throughout, you can get to a billion in just over 30 years.

Of course that’s a lot of assumptions. You can make these kinds of returns with smaller amounts, sure, but once you get to £100m or so, it’s no longer viable to invest in early stage companies because of the operational overhead of managing so many investments. You become a VC and at that stage you are lucky to make even a small return on your money. This is an identical situation to property development – it is possible to double your money each year by doing a few small deals, but scaling that to tens or hundreds of millions is not viable. At least with angel investing you are surrounded by lots of smart and interesting people..

There has to be a better way to get to the goal. Let’s consider who has been making fortunes of that scale recently? In the 90s it was people taking advantage of the major changes in country-wide political systems. In the 00s, it was people in large-scale property development. In the 10s it has been technology entrepreneurs. What is the relevance of this? And more importantly, what are the chances of becoming the next Mark Zuckerberg? I doubt they can be specified, but they are pretty low. Is it a viable strategy to spend your life starting a website and hoping it will become huge? No.

Let’s look at it in a bit more detail. Can we find any patterns arising in successful technology entrepreneurs? In my view, there is one very clear one, and it is based on the fact that we now live in a world of hyper-collaboration. A few centuries ago, if you were really smart then you could become the best at a number of different sciences, or skills, and achieve success entirely as an individual. This is simply no longer the case.

In technology entrepreneurship, we see that people within a close-nit network of already successful entrepreneurs are almost guaranteed to succeed with their next ventures – Space X, Palentir, Zynga, Mail.ru are prime examples. It seems that once you’ve made some money and you know the right people, your chances of success are drastically increased, as is the scale of those successes.

In effect, what you need is: the experience, skills, intelligence and entrepreneurial flair to be genuinely valuable, and getting these mainly involves hard work, then some startup capital to be able to invest with the other founders, and finally, most importantly, to be in the centre of the right network of people.

If this is what leads to success, then is it possible to make strategic decisions to get into such a position? I think that it is.

How do I invest?

And this brings us onto my investment approach. So what am I looking to achieve, given the goal mentioned before? I’m looking to put myself into the middle of a large-reaching network of entrepreneurs, founders, and founding teams who have demonstrated success. I’m looking to learn from them and their experiences, but more importantly I’m looking to build solid relationships. Some of these will be just professional contacts, but many will become friends. And finally, last and definitely least, I’m trying to minimise my chances of losing money on the investment. Whether I make a 1.5x or a 2.5x return does not make much of a difference, since I don’t see that being where I will build my genuine capital. The investment is simply a means to an end.

So how do I approach investing? What criteria do I have for choosing a company I invest in, and how do I determine how much to invest and at what valuation?

Firstly, because of the inherent risks in this kind of investing, any angel investor needs a large portfolio. My aim, assuming a 5 year exit on average, is to have 30 investments in the portfolio at any one time. I am currently up to 8, and any exits are still many years away, so it is likely that I will hit this figure, and the maintain it from that point on.

This approach also matches my main strategy of wanting to build the largest possible network of successful entrepreneurs. Since the plan isn’t to maximise returns it makes sense to work at all possible stages of investment, in order to have the broadest possible dealflow and network. I am an Octopus Venture Partner – happy to pay them their performance fee in exchange for the opportunity to meet and invest in entrepreneurs who have successfully raised VC funding. I work with a great angel syndicate called Angel Lab, where we go through tens of opportunities each month and select five to pitch to us at our monthly meeting. I also work with a number of introducer organisations, and go to many on the ground events in Tech City.

Assuming a company’s pitch has reached me, how do I determine if it is of interest? Firstly, I make sure it is in an area I could personally see myself working in at some point in my life. Understanding a business or an industry isn’t the problem – it is possible to learn anything, as long as you are willing to spend the time. However we are restricted by the 24 hours there are in the day, so what we choose to learn needs to be relevant. Hence a company which designs and manufactures hardware for automatic parking sensors is not that interesting, whereas a company which creates and markets an automatic parking platform, and simply buys in that sensor is very interesting.

Next come the people. The first step after reading the Executive Summary is to meet the founder. Things I look for include energy and drive, whether they have taken the company past the concept stage onto a path to success, the ability to take criticism and make it clear that they have understood and incorporated it, the understanding of the realities of tech entrepreneurship, the ability to inspire people to get involved (including me), matching attitudes and the likelihood of an opportunity to spend time in order to build a relationship. The important traits are their attitude and their ability to get things done. If this is there, then even if this particular company fails I still want to know them.

The first meeting is enough to veto people who don’t match the above description perfectly, but if they do then the next step is to meet the rest of the team. If there are co-founders who are similarly impressive, this adds to the value from investing in the company. At this meeting we discuss opportunities of collaboration. It is usually seen as a mistake to invest in a company because you think you can add some value to it, since this can skew your perception of the risk and reward, but genuine synergies for me are very valuable. At the moment I’m launching a company in the online retail analytics space, so I’m making investments which allow me the opportunity to gain learning, potential customers, and testimonials for the future.

If the founder and the team are interesting, the area is one I wish to work in, and there are some potential positive externalities from making the investment, then the decision at that point is effectively made – all that remains is to determine the risk of the investment, and then the amount.

I am honest about my own experience in valuing an early-stage technology company. There are many different methods which I’ve looked at and understood: Discounted Cash Flow, Cost-to-recreate, Market Multiple – but without using them regularly and on many companies I find it best not to delude myself into thinking that I can use them to get a correct result. It would take half a lifetime to get to a level of ability that is good enough.

There is also the issue of due diligence – trademarks, shareholders’ agreements, verifying the validity of the technology, and then after that managing the investment process and making sure that my minority stake is protected. A lot of time and energy needs to be dedicated to this.

There are two obvious solutions to this. The first is to set up an in-house investment management structure with teams of analysts and investment advisors, but that just takes extra time away from what I really want to do. I have a team in place at my company, Innova Kapital, but this is not the approach I usually follow.

The second solution, and by far the best in my opinion, is to rely on the wisdom of the crowd. Except in very rare occasions, I invest where this work is already being done, either by a group of knowledgeable professional investors, or by a fund or investment office. In a perfect world, there will be someone also investing whose opinion I trust, who has sufficient experience which is considerably greater than mine, and who values the return on the investment itself greater than I do.

The other investors in the company also form part of my future network, and are an important consideration in the decision making process. If there are some particularly successful entrepreneurs investing, this makes the company even more attractive.

Normally being a sheep and following other investors is yet another sign of a bad investor. With that approach, you can never manage a return that is better than average. Jimmy Goldsmith’s approach was to call other serious investors, and if he found out they were all investing then he wouldn’t. However, given my specific goal, for me this approach is perfect.

Assuming that there are other investors who give me the comfort needed to invest, the only question which remains is the amount.

The amount I invest depends on only two factors – my cashflow, which is currently from property investment and development, and the amount I feel is required to be taken seriously by the founding team and the group of investors. If everyone is investing £20k, then investing £30k is sufficient. If everyone is investing £100k, then I need to think twice about participating, since investing less than that will mean that I am largely ignored, and there may be the opportunity to use that money more efficiently by making 2 or 3 investments in other companies.

So far I have found that an amount of £50k is a reasonable sum in UK angel investing circles. I can request any information or assistance from the company if it is relevant for my own entrepreneurial ventures, and I end up having a regular meeting with the founder and his team to go over their progress and to plan out future collaboration.

Summary

- To summarise, my overall decision making process considers the following:

- Major variables: impressive founder, impressive team, availability of them to be in regular contact, matching attitudes, sector I’m interested in building a company in myself.

- Minor variables: areas of overlap and usefulness to my own current startup ventures, impressive investors involved.

- Veto: no other trusted parties investing in this round.

- Amount: current cashflow vs. capital table ranking.

- Follow the above approach.

- Build an amazing network.

- Start a huge company with the perfect founding team.

- Make £1 billion.

- Colonise space.

Of course it is one thing to reach the successful entrepreneurs and investors, it is quite another to actually build a relationship with them, and to be able to maintain a large number of solid, valuable relationships. But that is a whole other blog post!

Here is the link to download the slides for the talk which inspired this post – My approach to investing – by Ivan Mazour.

----Find out more on the about Ivan Mazour page.

And watch Ivan Mazour's TEDx Talk - "Why we shouldn't be scared of sharing our personal data".