In just this past week, about ten people have asked me to explain to them things related to Bitcoin. As an entrepreneur, I couldn’t help seeing this as some market demand, and responding with a blog post. The reason they’ve been asking me is that I’ve been a rather vocal early adopter of Bitcoin for a while now, so have been annoying people with my evangelism for a good year or so, and as the interest in cryptocurrencies has grown, I’ve ended up being the person to turn to for a crash course. I’m even on a panel about it at the Entrepreneur Country Forum in a few weeks.

In just this past week, about ten people have asked me to explain to them things related to Bitcoin. As an entrepreneur, I couldn’t help seeing this as some market demand, and responding with a blog post. The reason they’ve been asking me is that I’ve been a rather vocal early adopter of Bitcoin for a while now, so have been annoying people with my evangelism for a good year or so, and as the interest in cryptocurrencies has grown, I’ve ended up being the person to turn to for a crash course. I’m even on a panel about it at the Entrepreneur Country Forum in a few weeks.

Now what I really dislike about Bitcoin articles is that they always spend ages explaining what it is, in a way that is not interesting, or useful. So I’m not going to do any of that. Instead, I’m going to go through those few aspects of it that are really vital, in a really simple and quick way, with links to more information for those who want to do more research.

First of all, let’s start with my own Bitcoin story. I’d heard of Bitcoin since 2012, but early last year I decided to read up about it to understand more. I’d always been upset that I missed out on the in-game currency opportunity, and I suddenly realised that Bitcoin was almost like a time machine – an opportunity to get into something similar right at the beginning.

Now as a massive geek, for a couple of decades I’ve always kept a self-built gaming computer at home. These days I have little time to play properly, so it ends up being used for e-mails, but I still always upgrade it with the latest components, just in case. Since I had it anyway, and it had four of the latest GPUs, as soon as I learned about Bitcoin I started mining. The living room suddenly had this jet engine, powering away, raising the temperature of the room to 27C, but generating some Bitcoins. With a hashrate of about 1Mh/s, it took about a month to get my first Bitcoin.

Now as a massive geek, for a couple of decades I’ve always kept a self-built gaming computer at home. These days I have little time to play properly, so it ends up being used for e-mails, but I still always upgrade it with the latest components, just in case. Since I had it anyway, and it had four of the latest GPUs, as soon as I learned about Bitcoin I started mining. The living room suddenly had this jet engine, powering away, raising the temperature of the room to 27C, but generating some Bitcoins. With a hashrate of about 1Mh/s, it took about a month to get my first Bitcoin.

Over this month, I learned more about it, and got more and more excited about the prospects. And then suddenly, in April 2013, we had a big bubble, with Bitcoin going up in price to around £200. I’ve written a number of blog posts about making a billion, and this seemed like the kind of world-changing opportunity where people were going to do just that. So as soon as the price dropped back down, to about £40, I made an investment. Since I’m an angel investor in early-stage tech companies, I’m used to making a very high risk investment of a certain amount, so I just considered this another one of those, and added it into my portfolio.

At this point it didn’t make sense to mine anymore – firstly I had bought many more coins, but secondly the technology required to mine had changed. More on this later. So instead I started looking around at other currencies, while waiting for Bitcoin to go up. I discovered Ripple – a privately owned company with an even more advanced protocol and cryptocurrency, who had been backed by the best VCs like Google Ventures and Andreessen Horowitz, but who nobody had heard of. Here was the chance to get in even earlier than I did with Bitcoin. So I did, and I made an “angel investment” into Ripple as well.

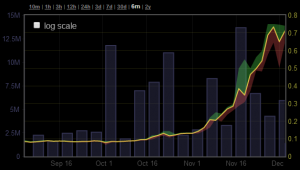

So now I had two different cryptocurrency stashes, and the year continued, with prices slowly going up. Suddenly at the end of the year, everything changed. Bitcoin price shot up, over just a few weeks, to £700. Ripple followed closely. The two investments combined were suddenly worth more than all the other investments I’d ever made. A fund-returner, in VC terms. It was difficult to sleep or think about anything else. The Ometria team had to take over for a while, as I spent most of the time staring at Bitcoin charts online.

So now I had two different cryptocurrency stashes, and the year continued, with prices slowly going up. Suddenly at the end of the year, everything changed. Bitcoin price shot up, over just a few weeks, to £700. Ripple followed closely. The two investments combined were suddenly worth more than all the other investments I’d ever made. A fund-returner, in VC terms. It was difficult to sleep or think about anything else. The Ometria team had to take over for a while, as I spent most of the time staring at Bitcoin charts online.

I cashed out at about £500. The whole stash, in one go, dropping the market by about 20% as I did it. I cashed out on Mt. Gox, of course, as it was the most obvious exchange to do it on. But then the prices kept going up, so I very quickly bought back in. The panic sell ended up costing me 20% of my total Bitcoins, which I was angry about at first. But re-buying ended up saving me 100% of them, as I withdrew the coins to my own wallet, instead of leaving anything on Mt. Gox and losing everything when they shut down.

After that, I realised that I am not a trader, and do not have the emotional guard in place to be able to make rational decision about such immense ups and downs, and that the best option for me was to simply sit on the coins, until I was ready to sell. The only thing I needed was to have a way out, so I’ve spent a bit of time now meeting all of the big players in Bitcoin, building relationships that would allow me to, at the right time, cash out of my whole stash in one go.

But sitting on a stash and watching charts is boring, so I’ve got back into mining. Now that Bitcoin mining is impossible for the typical individual, the only way to mine profitably is to do it for altcoins – alternative cryptocurrencies, which I will describe later. So I do that, and have a mid-sized mining farm operating out of my living room. The plan is to generate as much as possible in a profitable way, wait for at least one more bubble in cryptocurrencies, possibly two, and then to safely take out all of the capital, pay some capital gains tax, and split it by investing half into technology, and half into property. Leverage the once-in-a-lifetime chance for 1000x returns to create some safe capital. Hopefully my next blog post on the subject will be a happy one, and not one lamenting how I have lost everything..

The above was the story. Now for the crash course.. I want to cover the few aspects that I think are most important to understand, but without getting bogged down into too much boring detail.

1. Bitcoin, what it is, and why it’s interesting.

Bitcoin is just an accounting ledger and a protocol. That’s the only thing that needs to be understood. It is a giant document, currently about 10Gb in size, which contains the details of every single transaction ever made. Transactions are made between addresses, and the protocol is the technology that allows this. To own an address you need to know the password – the keys – to it. That’s it. If your address has coins in it, and you have the keys, you can send it to someone else. For ease of access, you can download a wallet, like this one which I use. This makes it easy to use the keys and to transfer the coins to other people.

The ledger is maintained by everyone who is mining coins, i.e. it is distributed across the whole world and is kept updated by everyone. This means no one controls it, although there are a few issues with this which I’ll cover later. Mining coins means using your computing power to solve a pointless cryptography problem. If you succeed in solving it, you have a small chance of getting some bitcoins. This adds no value to the world, but is a way of constraining the supply of bitcoins, and of creating a mechanism for distributing them. These days the chances of getting some coins is so small that people have created pools. Pools are technologies that combine the mining power of many different people, and then split the total proceeds fairly between everyone, based on computational power allocated by each one.

The reason all this is interesting, is because the world has been struggling, for years, to get rid of the concept of cash. We are quite happy with the banking system for long-term storage of money, and for large transfers, but for day-to-day payments the current systems are either too clunky, or too expensive. Bitcoin is electronic cash. You can have a wallet on your mobile, with however much cash you feel is safe, and then you can make easy payments anywhere you go. Or that’s the promise. In reality it is still a gimmick – those shops that accept Bitcoin do so for the PR value, not because it’s easier or because there is much demand to use it. But this demand is only growing, so although Bitcoin is currently still just a speculative investment, the fact is that a lot of money, and a lot of time, is being invested into the ecosystem, and this can only lead to increased adoption, and the shift from speculation to actual use. By the way, if you want to try it out, just go and order some food from www.takeaway.com – you can pay in Bitcoin!

2. Problems with Bitcoin.

It hasn’t been easy for Bitcoin. Over the years, many exchanges (places where you trade real world currencies for cryptocurrencies) have gone bust, been hacked, or actually just shut down and stolen people’s money. This is by far the biggest problem, and one that it’s vital to avoid by minimising the time you keep anything on an exchange. Money should be in your own bank account (although keep in mind this is also an exchange, so the same applies to a bank too), and Bitcoins should be kept in your own wallet.

Wallets can be hacked as well, usually by catching the password. Most Bitcoin wallets will have encryption built in, but in order to decrypt it, you will type a password into your computer, and that’s how they will catch it. So the key is to keep a computer, not connected to the internet, and used for nothing but the wallet. No downloads, no USB sticks – no viruses or keyloggers. Only use it to transfer coins in, and transfer coins out. Over the next few years, the most profitably way to be a hacker will be to steal wallets, so expect many distinct viruses coming out, for PC, Mac, Linux, mobile devices and everything else you can think of, to get access to all of these coins..

There are also some much broader problems, to do with the protocol itself – the aspect of Bitcoin that allows coins to be mined, stored, sent, and for all of this information to be distributed and sent. These problems include the 51% problem, which means that if you control more than half of the computing power of Bitcoin, you have total control over the ledger, and can actually change it forcing all of the other computers to follow the changes you’ve made. Another problem is the transaction malleability problem, which was the cause for the collapse of Mt. Gox (although this isn’t certain – they may have just stolen the money themselves) through attackers forcing exchanges to not correctly account for transfers, and send more coins for transfers that had already happened.

Finally there is the problem with regulation. Thailand has banned it. China has banned it, ish. Russia has banned it, ish. The UK tried to call it a voucher, which would have led to all sorts of tax problems, but has ended up sorting itself out. The USA has said that it can’t ban it. So it’s very difficult to know what exactly is going to happen, now that Bitcoin is big enough to have an impact on governments. We could end up with a highly-regulated ecosystem, which removes all of the new value and the excitement, leading to its final demise. We could end up with absolute total disruption to the world’s monetary system. This is all being played out, right now.

3. Altcoins. Or alternative coins.

Since the Bitcoin technology is completely open-source, people have started to create their own clones of it. Each one is slightly different, but the only thing that really matters is the marketing. Setting up your own cryptocurrency is really easy. What’s hard is to get people to mine it, to trade it, and to build the various aspects of the ecosystem that are required. There are currently 140 altcoins, which you can see here, but by the time you read this, this number will probably be out of date.

A few interesting things about altcoins. Most are actually based on Litecoin, not Bitcoin. Litecoin is the biggest of all the proper altcoins, and uses a different algorithm. Almost everything I described above in points 1 and 2 applies, although some aspects of the protocol have been improved. Litecoin is cheaper in price than Bitcoin, and tends to follow its movement in price – it’s the silver to Bitcoin’s gold.

So all these other altcoins, except for one, are mostly based on Litecoin, and exist because a few programmers wanted to try out replicating the code. As I mentioned, the hard part is to get people interested enough, so the key is to build up hype. Hype means lots of people mine, and others want to buy. This means prices go up, and you can sell it for a large profit – what’s known as the pump and dump. The most successful coin of the moment is Dogecoin, a coin based on an internet meme. Because it’s different, and amusing, it’s attracted the required attention, and has led to 400% gains in just one day. Of course there is now a clone, called Catcoin, and the whole cycle will continue. I spent a week mining Coinye West, until it was shut down. I’m tempted to go for some Kim Coindashian, but I get the feeling that’s not going to go very far either.

The only other altcoin worth mentioning is Ripple. This is completely different to all of the other altcoins. It is privately owned, rather than distributed, so the ledger is operated only by them. It is pre-mined, so there is no need to waste computing power. The owners will give away most of the coins, keeping some for themselves, hoping that their stash will keep them running through the initial years, and will end up being worth billions. The protocol itself is much more advanced than Bitcoin – it is faster, and it allows the trading of all sorts of currencies, not just Ripple. So you can use the Ripple protocol to actually trade Bitcoins, or dollars, or anything else you want. It is still in beta, and extremely risky, but they are well capitalised, backed by some very smart people, and have a chance of totally displacing Bitcoin as the global cryptocurrency and protocol.

4. Buying and selling cryptocurrencies.

If you’ve read this far, it’s a safe bet that you’re interested enough in cryptocurrencies to want to own some. So here are the important aspects of buying and selling them. Firstly, get accounts at as many exchanges as you can. The vital one is Bitstamp, it is the core exchange, at least for the next few years. It’s considered the safest, and has the largest volumes. But also get BTCe, Kraken and itBit. In America, add Coinbase into the mix. With all of these exchanges, get verified, which involves sending proof of identity, to the highest level possible, so that you can make larger transactions. And make sure that your passwords are as secure as possible, preferably using two-stage authentication.

Once you’ve done this, each exchange will have an account to which you can transfer money, usually in Euros, and usually requiring a specific reference. Keep in mind that these are all unregulated amateur operations. Customer support will be awful, and there will be no one to turn to if things go wrong. So mistakes aren’t allowed – if you don’t put a reference, it may take months to get the money back, and you may not get it at all. But if you follow the instructions, things tend to work out.

When the money is in the exchange, you have two options. You can trade it all in one go, or you can go a bit at a time. Depending on your free time, your interest, and your trading skills, one of these will be more suitable. It’s usually better, to buy a bit at a time, as you can ride any waves and average out your entry price. It also means, if you’re buying a lot, that you don’t move the market and get in at the best possible price. But, for the reason described above and below, you don’t want to keep anything on an exchange for very long, so it’s much safer to buy and sell quickly.

Once you have cryptocurrency, you need to transfer it to your local wallet immediately. Any one of these exchanges can fail, and there will be no warning if they do. So you don’t want anything sitting in an exchange. Transferring out Bitcoin is easy – you get your wallet address and type it into the exchange. Sometimes this can go wrong, as it has done for me, leading to weeks of trying to get in touch with customer service, but usually this part is hassle free.

So now you have cryptocurrency, on your own computer, which you are keeping as safe as possible. Encrypt the wallet, back it up somewhere, say Dropbox, but only ever open it on that one computer that you know is virus-free. If someone catches your password, that money is gone. All that’s left is to wait for the next big bubble, and then face the immense dilemma of whether to cash out, or ride it out for a bit longer. Believe me, unless you’ve already lived through that, it is an experience that you cannot imagine, and a psychological experiment on yourself that is so fascinating, it will take over your life.

5. Mining cryptocurrencies.

And now the last bit. Mining. If you’re not a complete nerd, then ignore this last part, as it requires some serious technical knowledge, and quite a bit of patience too. But if you’re into building computers and messing around with software, then this is the fun part!

A brief history. Mining involves combining computer hardware, computational power, and electricity, to create Bitcoins. The first three cost money, the last one has value. Hence it’s an equation, that people try to solve in a profitable way. The first people could use a basic computer to mine Bitcoins, and get tens of thousands of them very easily. As more people became interested, it became harder. The more people mine, the higher the “difficulty” gets, and as time goes by, the reward you get for successfully solving the cryptography problem gets smaller too – this is part of the protocol that ensures that supply is constrained, and that there can only ever be 21 million Bitcoins. Once thousands of people started mining, it became highly unlikely that you’d be the person that would solve the problem, and people started mining through pools, collectively, and sharing the rewards. At this point any aspect of chance was removed, and you could equate total computing power, or hashrate as it’s known, with total production of Bitcoins.

Because of this, people started looking for ways of increasing their hashrate, and created software that allowed you to mine Bitcoins using a GPU – a video processor usually used for gaming. This was many orders of magnitude more powerful than a processor. A top-end GPU can mine at almost 1 megahash a second, whereas a CPU tends to do just a few dozen kilohashes. But even that didn’t last long, because given the opportunities in Bitcoin, there were people constantly pushing to get an edge. Just like GPUs made CPU mining unprofitable, newer technologies like FPGA mining made GPU mining unprofitable. And finally, after years of research, specialist companies released ASIC technology – machines which can do nothing but mine bitcoin – which were so much more powerful than anything that came before, that it meant that anyone who didn’t have one could not possibly mine profitably. Current ASICs mine at terahashes a second, literally billions of times faster than a processor.

Because of this, people started looking for ways of increasing their hashrate, and created software that allowed you to mine Bitcoins using a GPU – a video processor usually used for gaming. This was many orders of magnitude more powerful than a processor. A top-end GPU can mine at almost 1 megahash a second, whereas a CPU tends to do just a few dozen kilohashes. But even that didn’t last long, because given the opportunities in Bitcoin, there were people constantly pushing to get an edge. Just like GPUs made CPU mining unprofitable, newer technologies like FPGA mining made GPU mining unprofitable. And finally, after years of research, specialist companies released ASIC technology – machines which can do nothing but mine bitcoin – which were so much more powerful than anything that came before, that it meant that anyone who didn’t have one could not possibly mine profitably. Current ASICs mine at terahashes a second, literally billions of times faster than a processor.

The problem with ASICs is that there is an inbuilt moral hazard, and prisoners dilemma. The companies making each incremental one would make more money by mining than by selling them. But once another company also had them, then it would just turn into an arms race, and there wouldn’t be a competitive advantage anymore. So in a perfect world, everyone would have CPUs, and you’d be the only person with a terahash ASIC. But of course that’s impossible. So the companies sell the ASICs to miners instead. However they of course use them to mine their own coins when they come out, so by the time the consumer receives their ASIC, it is no longer a competitive advantage, and it becomes almost impossible to actually make money on them. So, these days, only if you’re the company that constantly manufactures better iterations is it possible to make significant profits from Bitcoin mining.

The problem with ASICs is that there is an inbuilt moral hazard, and prisoners dilemma. The companies making each incremental one would make more money by mining than by selling them. But once another company also had them, then it would just turn into an arms race, and there wouldn’t be a competitive advantage anymore. So in a perfect world, everyone would have CPUs, and you’d be the only person with a terahash ASIC. But of course that’s impossible. So the companies sell the ASICs to miners instead. However they of course use them to mine their own coins when they come out, so by the time the consumer receives their ASIC, it is no longer a competitive advantage, and it becomes almost impossible to actually make money on them. So, these days, only if you’re the company that constantly manufactures better iterations is it possible to make significant profits from Bitcoin mining.

The solution is to move to altcoins, which all individual miners have now done. Litecoin, and the others, are based on a different algorithm to Bitcoin, which is not easily adapted to custom hardware. So mining Litecoin using an ASIC is no better than to do so with GPUs. I currently have an 8 MH/s mining farm operating out of my living room. It includes my gaming computer, that I’m typing this on, and an additional 6-GPU rig which was built just for mining. It takes just over two weeks to generate me a Bitcoin, but it does so by first mining the most profitable of all the altcoins, and then once a day exchanging that for Bitcoin and sending it to my wallet. I use a pool to automate that – Middlecoin – which takes a high fee, but also takes all of the hassle out of it. I just keep the computers running, and receive my Bitcoins.

Now onto the hardware. The point is to realise that profitability on mining should be measured in cryptocurrency, and not in fiat currency (Pounds / Dollars). When you buy a machine, you need to consider how many coins that hardware is worth, and then make sure you get that many coins back over its lifetime. Because otherwise, the huge fluctuations in Bitcoin / altcoin prices could make it seem like you’ve made or lost a lot of money, but in reality you may have been much better off just investing the cash in the coin, rather than purchasing mining equipment.

My 6 GPU rig cost me 5 Bitcoins. If all goes to plan I should make that back in under half a year, and everything after that will be profit. If difficulty increases too quickly then this will drop, but the current fluctuation in price is likely to prevent many new miners entering, so this should be a good period to get positive ROI on the operation. And most importantly, I want to be in a position to leverage any altcoins that arise – I have no doubt there will be more “Dogecoins” with huge short-term opportunities, and I want to have the hardware ready and available so I can point it in the right direction.

So here’s the really technical part. Having spent many weekends trying to get it all to work, here’s a guide to avoiding all of the pitfalls, and to really easily putting together a mining rig. Firstly, go for this very specific hardware. Any changes, and there will be additional small problems that you will definitely run into. Here’s the list:

MSI Z87-G55 Motherboard

Intel G1820 Celeron Processor

4GB Corsair DD3 Vengence Ram

1000W EVGA SuperNova PSU

1200W NZXT Hale PSU

6 Sapphire Radeon R9 280X Toxic OC GPUs

6 1x to 16x PCIE powered risers (ebay, don’t go too cheap)

Not-cheap 8GB USB stick

Netgear Powerline adapter

Belkin WeMo adapter

Generic electricity power monitor

4-way extension cable

Very thin wire for electronics

3 33L stackable milk crates

6 DVI to VGA adapters

Add2Psu adapter

Dremel tool for cutting

All of the above works perfectly. And this is what it looks like. Any changes and it probably won’t. If the above doesn’t work, then one of the components is broken – that’s the only reason.

All of the above works perfectly. And this is what it looks like. Any changes and it probably won’t. If the above doesn’t work, then one of the components is broken – that’s the only reason.

Now once you have all of this, firstly build it. The PSUs go in the bottom crate, the motherboard and everything else in the top crate. The third one is just to raise both of them so you don’t have to keep bending down – I don’t actually use it now that everything is running. Use the dremel to cut some holes for the PSU cables to get through to the motherboard and GPUs. The DVI to VGA adapters aren’t actually used, but they extend the length of the graphics card so that you can rest it perfectly on the top crate, opening them up to air for cooling. Always start with one GPU just to make sure everything is working, and only then go up, one by one, until all 6 are running. This will not be easy. Many annoying things will go wrong. But you’ll get there in the end. Use the Add2PSU adapter to make sure both power supplies start together. Connect the 1000W one to three GPUs, and the three relevant powered PCIE risers. Connect the 1200W one to the other three GPUs, the other three risers, and to all the other components such as the motherboard. The power cables should be plugged into the extension cable, so this way you have one single plug which powers both PSUs. When you first start it, which you’ll need to do by using a screwdriver to short the power switch pins on the motherboard (use the manual to find these) go into the BIOS and make sure that it’s set to automatically power on whenever power is restored. This way, all you need to do to turn it on is to unplug it, wait a few seconds and plug it back in.

Once the hardware is connected, here are the guides to follow. Firstly install BAMT onto a USB stick, by following the instructions here. This is a pre-set Linux distribution that has everything you need to mine. On the hardware above, it will just work. If it doesn’t you’re using something different, or your USB stick is dodgy. The instructions will show you how to change the cgminer.conf file – this is the most important, and hardest part. BAMT doesn’t require you to do anything – it should just start mining as soon as you boot up the computer, which you can tell because the graphics cards will make a lot of noise. If they don’t, then the config file is wrong. Here is the one I use – if you have the same hardware, then this should work perfectly. The only thing you have to change is your Bitcoin address, nothing else.

Once you’ve got it all set up and working with one GPU, then follow this guide here to go through each of your GPUs one at a time and flash their bios to undervolt them. This will decrease your electricity usage, decrease your heat generation, and improve your overall mining efficiency. This is for the specific GPUs above, so don’t do it for any others. Also, these GPUs have a BIOS switch, so use that switch to change to the 2nd BIOS, and flash that one – that way you can always just go back to the original BIOS by pressing the button on the card.

Once all the GPUs are ready, start adding them in, one by one. The first few will work, but sooner or later they will stop being recognised. When they do, follow this guide here for the slot that isn’t working. You need to use the wire to short two pins on the slot. Once you’ve done that properly, it will work. Note there are 7 slots but only 6 of them will work at once, even with the wire trick. One won’t. By the end you’ll work out which one that is.

So now you should have the machine hashing at 4.5Mh/s. Plug in the Homeplug adapter so you can put it anywhere you want in your home, plug in the WeMo adapter so that you can reset the actual power over the internet. If anything goes wrong, you can use this to disconnect the power, give it a few seconds, and reconnect it. The BIOS will catch it, turn on the computer, and then BAMT will automatically start the mining. Then plug in the electricity monitor – you want to see how much power you are drawing, and how much it is costing you, to be able to measure profitability.

And at this point you will have a box making lots of noise, making you lots of bitcoin, hopefully hassle-free. And you’ll immediately want to build another one, and then another one, and you’ll end up like this guy here..

So that’s it, that’s all I can think of that is absolutely vital to know about Bitcoin, cryptocurrencies, buying them or mining them. I’ll gladly answer any questions in the comments, so leave me one. And if you do build a mining farm, then drop me a line – it’s always good to compare notes. Now it’s your turn. Get involved, and spread the word!

----Find out more on the about Ivan Mazour page.

And watch Ivan Mazour's TEDx Talk - "Why we shouldn't be scared of sharing our personal data".

7 comments

Hi Ivan,

Great article and love your personal story of riding the wave as well as your passion for the topic!

I see Bitcoin very differently; to me at a fundamental level it’s an excellent example of a lot of what is wrong with the capitalist system today. It is built on the principle of converting common property environmental resources (Energy, Water, Atmosphere, Ecosystem, Bio Diversity) to Money.

It does it so eloquently that by design it excludes those most in need of money (Populations in Poor developing country’s) from accessing the system due to inherent lack of education, infestructure and hardware required to do so. This is perhaps even more poignant as it will be these excluded populations who will suffer the harshest consequences from Climate Chaos and are the most in need of a sustainable income.

If you have studied the fascinating field of Environmental Economics you will be aware that it is extremely easy to make a profit today by destroying environmental assets, due to their inherent undervaluation. As our economic system fails to account for existence, option, and bequest values of these assets.

I cant help but feel that Bitcoin is a like something out a phycology experiment or joke book. How do we get people to destroy the planet quicker? How about we pay people in rich developed nations to convert the planets limited resources to money, great idea but we need to do this REALLY fast… lets harness Moore’s law – the result, Bitcoin!

I think our great grand children will look back on the “Bitcoin Generation” in a similar way that we look back on entrepreneur’s who built businesses from the slave trade. If you start with something based on a Morally shady ethics, it naturally attracts people with similar values such as Scammers, Hackers and Drug Dealers…wait isn’t that the main Bitcoin user base? 😉

Cant we just go back to trading Tulips?

Wow, intense comment Liam, but a very valid opinion. Thanks for taking the time.

I guess as technology entrepreneurs, we are always looking for ways to hack life. The companies we are building add a lot of value to the people who pay for our goods or services, but they also allow the transfer of wealth from them, to us. The plan, I assume in both our cases, is to then use this capital to change the world in a grand way, as described in my approach to investment. So I see Bitcoin as just another way to hack life, or rather hack capitalism. The early adopters are going to win, a lot. It’s up to those people to put that capital to good use. The one thing that we can be sure of is that the transfer is not from the poor to the rich – the people who originally got into bitcoin were geeks and early adopters. The people getting in now are institutions and high-net-worths. By the time that Bitcoin is global, and all members of society use it, it will no longer be a speculative investment, but will actually be used for its core purpose.

The one point that you’re absolutely correct about is the ridiculous process of wasting resources for no genuine reason. That I completely agree with, as do all other bitcoin afficionados. That’s one of the reasons that the second generation cryptocurrencies have removed the requirement to mine – e.g. Ripple. I don’t believe that future generations will look back on the Bitcoin Generation as slave traders or ecological pirates. I believe they’ll look back at the small blip of insanity when the mining was being done with no purpose at all, but then will see how this was quickly turned into a productive use of resources. Ripple has already done this with their Computing for Good project, and it’s clear that for cryptocurrencies to succeed, all of them will have to switch to a similar approach.

I really do hope that this will not go down in history as just another mania, and that we are living through a huge, transformational moment that our children will learn about at school.

Hehe yeah looking back came across more intense than I meant it to be. Its good to here that Mining is being phased out of future Cryptocurrencies and hopefully Bitcoin one day. As well as the has been a move to re-focus the computing power for good use.

An insightful article and the is certainly many bigger picture positive points to the potential mass adoption of Cryptocurrencies. As always a fascinating article and topic thanks for sharing.

I love this article, not involved in tech and always got lost in discussions about bit coin.

Personally I love the idea of a global currency, but the world is run by nation states and despite the US’s stance today, I don’t think they can afford to have an unregulated untaxable currency in the world, I guess we will see… Couple of quick questions, if everyone has a copy of the ‘ledger’ and the ledger has all the info and shows all the transactions that have ever happened, how are people able to steal coins? Surely there must be a way to regulate stealing by forcing owners of coins to highlight where and how they last got them and include that within the ledger that everyone has?

Also I can’t believe there is a doge coin, does no-one think that sounds like dodgy coin? (I get the dog part when you followed with the cat coin after, but still reads dodgy to me)… Then again with kanyewest/Kardashian coins, I guess creating hype in a crytocurrency has little to do with establishing confidence in the name they are using, as long as it is recognisable and catchy to the masses- it really is simply a marketing ploy…

Despite you simplifying and clarifying the process of buying coins fantastically in the article, it still seems quite complex and a bit of a headache- especially the part about making a mistake and then taking months to get ahold of someone to solve it. Could there be an opportunity in creating a niche secondary market that allows you to access the primary market (actual coins) for a fee without any headache and possibly some good customer service? Consumer base would be laypersons, gamblers, etc; but I assume there is probably already a coin index which people can speculate on from real markets?

Finally, never defend the geek in you!! We are no longer cave men, the world is ever trending away from physical strength and today it’s the geeks who take home the prom queen!! Which you really should know because you have been proving that point yourself for a long time now lol… 😉

Great blog bro, love it! Andrew in Yangon…

The geeks are here to rule – no doubt about that! Awesome to hear from you Andrew, hope Myanmar is treating you well.

You’re totally right that the US has no intention of having an unregulated untaxed currency, but they’ve missed the boat now, and cryptocurrency (even if not Bitcoin) is here to stay, so they’re quickly getting on top of it and starting to legislate for it. That’s why the US is actually the country that is doing the most to support and regulate bitcoin, unlike say Russia which is still trying to ban and ignore it.

Although everyone has a copy of the ledger, there is no clear link between a bitcoin address on the ledger, and the person who owns that address (or rather who has access to that address). So you know exactly where the bitcoins are, but you just don’t know who can get to them and spend/exchange them. And on top of this, there are lots of bitcoin laundries, where you can send your coins, they get mixed up with lots of other people’s coins, and then withdrawn again. So assuming you use a different address to withdraw them (addresses are free), then this effectively completely destroys any trail that can be followed.

The secondary market for this stuff is the biggest opportunity right now. There are a couple of ETFs being launched this year, like the SecondMarket one, letting the general public invest in Bitcoin without all of the hassles. Huge opportunity for this, especially outside of the US where people haven’t even started working on it. Some huge opportunities there for people who understand both the traditional finance industry, and the new crypto one. What do you reckon – next venture?

You’re joking? I built a 6 card LTC mining rig around xmas time!

Ha! Great minds Chris..